Analytics, EU – Baltic States, Financial Services, Legislation

International Internet Magazine. Baltic States news & analytics

Friday, 19.12.2025, 18:19

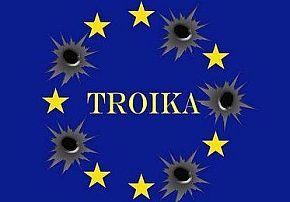

EU’s financial and economic stability: “troika” actions revised

Print version

Print version |

|---|

In order to assess the effectiveness of the Troika (ECB, IMF, European Commission) the European Parliament's Economic and Monetary Affairs Committee held in January 2014 hearings with European Commissioner Olli Rehn, former ECB President Jean-Claude Trichet and the ESM Executive Director, Klaus Regling. MEPs concluded that "the European mechanism to counter the crisis needed true democratic accountability and clear channels of responsibility”.

They argued that “troika” should take the social impact of its decisions more into account and have the ability to correct policy recommendations when they were seen to be inadequate.

The EU's crisis-fighting mechanism needs true democratic accountability, clear channels of responsibility, more consideration of social consequences, and an ability to correct policy recommendations when they prove inadequate. These were some of the first conclusions MEPs drew in Thursday's discussion on draft report analysing the operations of the European Central Bank/IMF/EU Commission “Troika”.

Source: ECON Press release “MEPs anticipate end of the Troika”, Economic and monetary affairs, 16 January 2014.

MEPs in the Economic and Monetary Affairs Committee, led by co-rapporteurs Othmar Karas (EPP, AT) and Liem Hoang Ngoc (S&D, FR), have held hearings with key Troika players and received many replies to questions sent to the Troika institutions and authorities of the “programme countries” whose anti-crisis measures they advised. MEPs have also paid fact-finding visits to Lisbon and Nicosia, and will visit Dublin and Athens, by the end of January.

Parliament is to approve the Troika inquiry’s final findings in a plenary vote in April.

Looking ahead

Opening discussion, O. Karas stressed the need to bear in mind that the EU had been caught on the wrong foot when the crisis hit and had lacked both the financial means and the expertise to handle the flailing countries. There may therefore have been no alternative to the Troika at that time, but "We now have the funds and systems to control national budgets so we must get the system within the normal EU process," he said.

L. Hoang Ngoc said that the role of the European Stability Mechanism, the EU bailout fund, should be stepped up and that the European Parliament should have a bigger say in decision taking, especially as regards what “conditionality” strings to attach to financial assistance. "Disputes between the Commission and the IMF over whether to use fiscal consolidation or devaluation led to both having been applied, causing excessive damage", he said.

These views were echoed by many others, with Philippe Lamberts (Greens, BE), also suggesting that a future firefighting system would enable the European Parliament to give the Commission a broad mandate for action, but also a right to send back a specific reform roadmap (Memorandum of Understanding) back to the drawing board if necessary.

A bad day for responsibility

MEPs lamented the difficulty of assigning any form of responsibility to a specific player or institution. "It is disappointing that nobody is able to say ‘mea culpa’ in all this", commented Olle Schmidt (ALDE, SV). Others remarked that a normal democratic structure should make it possible always to ascertain who is responsible, arguing that this proved the Troika's lack of democratic and transparency credentials.

Other MEPs criticised the alacrity with which some Troika officials had blamed governments and appeared to exonerate private companies, which had also played a big part in tipping the EU into crisis.

Mistakes

MEPs criticised the Troika less for making mistakes than for failing to correct its recommendations when they proved inadequate and detrimental. The alternative model must be one based not only on austerity, they said. Social considerations must be factored in and the policy of making ordinary people pay the most of the bill must be changed, said Marisa Matias (GUE/NGL, PT).

Major challenges remain

The latest auctions of Irish, Portuguese and Spanish bonds have seen yields drop very significantly. Economic sentiment indicators in the euro area have now returned to their long-term average, with positive contributions from the vulnerable countries. Forecasts across the board now clearly point to a strengthening recovery. Hence, discussion of the workings of the Troika is very important, the Commissioner underlined.

However, unemployment is unbearably high in a number of Member States, even if there are signs of a turning point. Persistent reform efforts continue to be necessary for growth and jobs, which applies to all EU member states (however, most important are the euro area so-called “programme countries”). This includes the former programme country Ireland, which successfully concluded its programme in December 2013 and demonstrated that the program's goal to regain market access has been reached.

Commissioner mentioned that the roots of the crisis lie in macroeconomic imbalances that were built up over the previous decade. The macroeconomic adjustment programmes did not mark the beginning of the crisis, but a start of its resolution. The programmes suggested by the Commission prevented disorderly defaults with all the devastating economic and social consequences that would have entailed.

The

European strategy has followed the approach of extending solidarity in return

for solidity. This principle has remained, while the structures have

substantially evolved since May 2010 when the urgent instruments had to be

created in dramatic circumstances and under terrible time pressure.

The Commission certainly favored a Community solution; it made a legislative proposal to that effect, which led to the creation of the Community “stability instrument/mechanism”- EFSM, while the EAMS opted for an intergovernmental arrangement.

However, in the heat of the crisis and with the urgency to prevent an economic free fall, some compromises were made (however, the unanimity rule prevailed, and each EAMS had a right to veto). The situation was such that Europe had to rapidly create structures that were not foreseen ― for a crisis that was not foreseen, either.

The Troika came into being under extreme political and time pressure to avert an immediate default by Greece on its obligations, which included the welfare benefits of Greek citizens and the wages of its public employees.

These structures have over time been developed through democratic processes in the member states and at the European level. With the set-up of the European Stability Mechanism, it was recognised that a permanent firewall was necessary, in the form of a capital-based international financial institution. In this framework, the final decision and responsibility on granting financial assistance lies with the euro area states; they face their own constraints, both political and financial.

Reference: Olli Rehn, Vice-President of the European Commission responsible for Economic and Monetary Affairs and the Euro; Speech/14/14 at the Parliament’s ECON Committee Hearing on the Troika Report. European Commission, 13 January 2014.

Troika’s legislative background

The role of the Troika has been formalised in the EU legislation: in ESM Treaty, as well as through co-decision in the “two-pack” legislation (20011), which lays down the rules on transparency and accountability of the Commission in its role as a member of the Troika.

In this respect, the Commission has also been engaging in dialogue with social partners in the so-called, programme countries. However, the ownership of the programme by the beneficiary member states is always key for a successful economic turnaround.

Each of the Troika institutions acts within its own constitutional and legal responsibilities. The Troika model has allowed the EU to draw on the combined experience and expertise with other two institutions (IMF and ECB).

The policies that led to the accumulation of macroeconomic imbalances fall under national responsibility. Key factors included rigid market structures, often dominated by powerful organised interest groups, as well as oversized and inefficient public sectors. While sometimes requiring difficult decisions for particular groups, structural reforms help to spread the benefits from growth across society.

Social fairness must go hand-in-hand with sound public finances. For instance, a more efficient tax system with fewer exemptions or loopholes to prevent tax avoidance can contribute to both efficiency and fairness.

In the healthcare sector, reforms can lead to significant savings and more cost-effective provision of patient care. Much has been done in this sense in Greece, for example by streamlining the social security funds, introducing e-prescriptions, pushing generic medicinal products, and reorganising hospital capacity.

Very often

structural adjustment from accumulated macroeconomic imbalances to sustainable

economic development involves difficult and often painful choices. Here the

responsibility lies, first of all, with those who let these imbalances

accumulate, with all their social consequences.

In this respect, it is first and foremost for the relevant Member State to put forward the measures or decisions needed to correct the imbalances, while prioritising social fairness and in dialogue with the Troika partners.

Democratic accountability in the EU crisis resolution strategy (and its success) was in great sense predicated on wide acceptance of the need for reform in the beneficiary country, e.g. in Ireland and Portugal, as well as in Spain and Slovenia, where the strong commitment to reforms avoided the need for a macroeconomic adjustment programme.

In contrast, political turbulence largely derailed progress in Greece from spring 2010 to summer 2012.

The purpose of macroeconomic adjustment programmes is to remedy emergency situation in a sustainable manner; this requires taking determined action under enormous time pressure and in very difficult conditions.

In restoring economic confidence, once the emergency is over, the reform process is continued under the normal procedures of economic governance.

Therefore, the EP Committee's draft report acknowledges the immense challenges the Troika faced given the scope of the present crisis, by taking into account the specific situation in different Member States, the limited tool kit available at the time and the extreme time pressure under which decisions had to be taken. This fact was also acknowledged by the authorities in the beneficiary Member States in their replies to the Commission.

Under the current circumstances, the view of all Troika partners is that the Troika functions reasonably well in difficult circumstances and the institutions concerned should continue their joint work for the near future.

The Commission will keep up its constructive cooperation with the Parliament’s ECON committee; the future and governance of the Troika will become part of the wider institutional discussions in the process of deepening EMU. Realistically, a deeper fiscal union will not be achieved overnight: for the Commission, the guiding principle is that stronger solidarity can only be pursued in return for stronger responsibility ̶ and it can only emerge in a profoundly democratic process. The European Parliament is at the core of this debate.

Reference: http://europa.eu/rapid/press-release_SPEECH-14-14_en.htm?locale=en

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!