Analytics, EU – Baltic States, Investments, Latvia, Markets and Companies, Shadow economy, Taxation

International Internet Magazine. Baltic States news & analytics

Thursday, 08.01.2026, 19:11

Foreign investors: shadow economy has to be reduced in Latvia before tax hikes are considered

Print version

Print version

When asked if taxes should be raised in Latvia, Greiskalns said: "Probably, this needs to be considered", stressing that there is a number of measures that should be taken before that, for example, measures against the shadow economy, which would make it possible to increase budget revenue and eliminate illegal businesses from competition.

When asked to evaluate the business environment in Latvia, Greiskalns said investors had a certain feeling of insecurity about the future. He criticized the government for slow progress in implementing reforms, for example, reducing labor taxes and increasing taxes on consumption.

The government is aware of the problems in the country, but no there are no noteworthy attempts taken to find solutions to these problems, said Greiskalns.

|

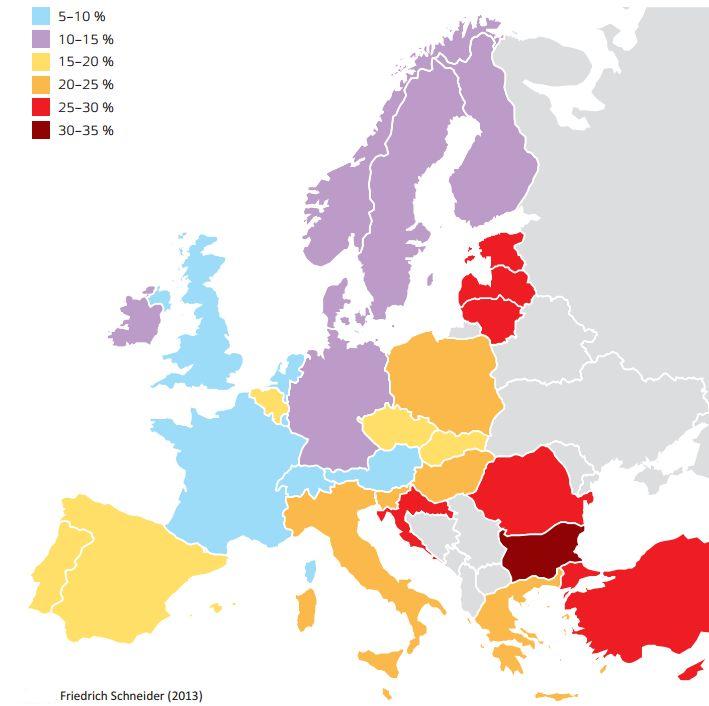

| Shadow economy in Europe |

Latvia's investment climate has also worsened due to the situation in Ukraine, and investors are currently unwilling to invest in Eastern Europe, Greiskalns added.

As reported, Minister of Finance Andris Vilks (Unity) has urged a public debate to consider whether taxes should be increased, as due to the low taxes in Latvia, the national budget runs low on resources to satisfy all needs and interests.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!