Banks, Direct Speech, Economics, Estonia, Financial Services

International Internet Magazine. Baltic States news & analytics

Tuesday, 10.02.2026, 23:07

Rebounding confidence in the summer has led companies to borrow more actively in the autumn

Print version

Print version |

|---|

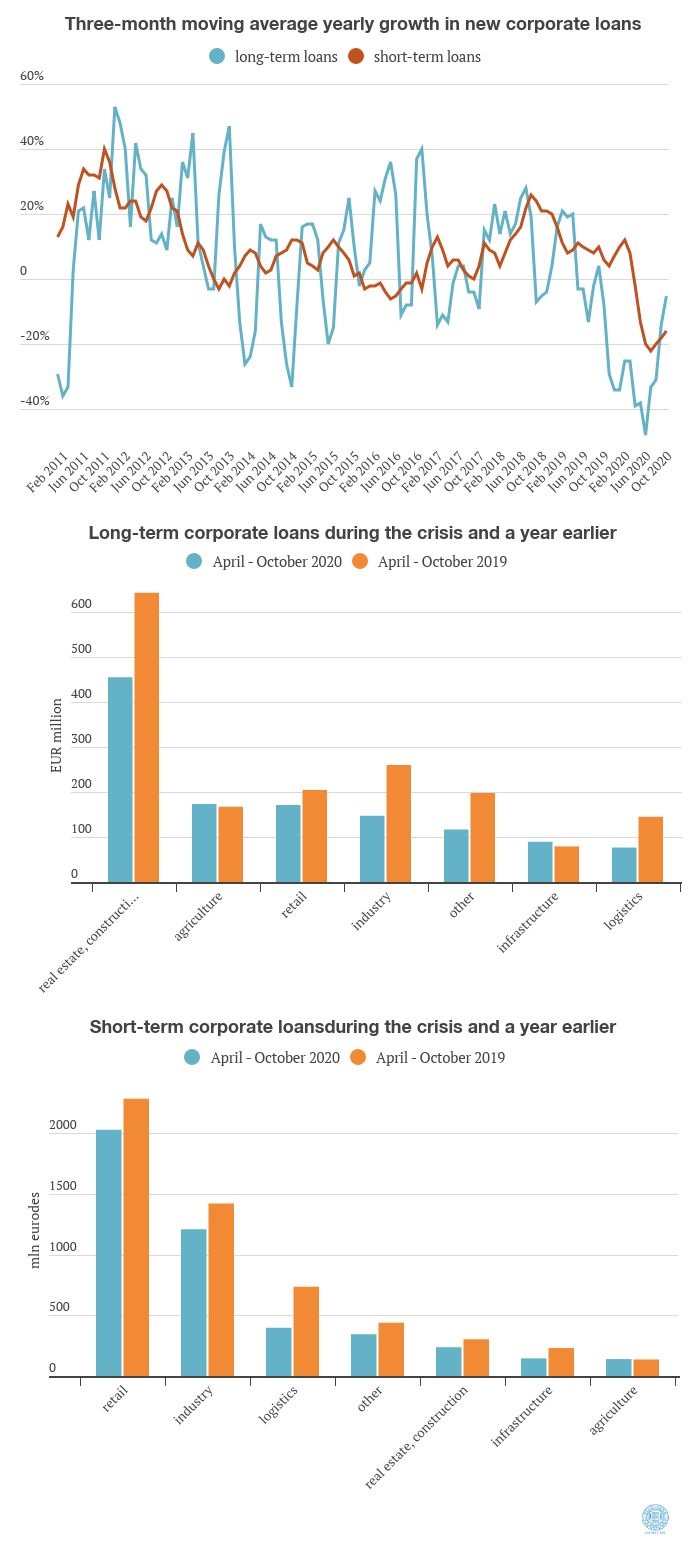

Like in earlier crises, the take-up of new long-term loans fell by more when the crisis started in the second quarter than that of short-term loans did, and it was 48% below where it was a year earlier. The volume of short-term loans issued in the second quarter was 20% smaller than it was the same quarter of the previous year.

Confidence rebounded somewhat in the summer though and the recovery in new long-term loans issued to companies was faster than that in short-term loans. New long-term borrowing was 19% more in October than it was a year earlier, while 18% less was taken in new short-term loans.

The changes in new borrowing from banks by companies varied across sectors. There are several possible reasons for this, as operating volumes declined by different amounts in different sectors, sectors entered the crisis starting from different financial positions, and there were some differences in how support measures were issued to sectors during the crisis.

The accommodation and food service sector, which was hit hardest by the crisis, has continued to take the same amount in long-term loans as previously, which could indicate that accommodation providers see the drop in the economy as providing an opportunity to invest and refurbish. Long-term borrowing has also remained strong in the infrastructure sector, probably partly for seasonal reasons and largely because investment by the state has continued. Infrastructure companies took 13% more in long-term loans in the seven months from April onwards than they did in the same period last year. The primary sector, which covers agriculture, forestry, and hunting and fishing, has borrowed the same amount as before in both long and short-term loans. This may be because of the seasonal nature of the sector, as new machinery is needed in summer and autumn for agricultural work. The growth in new loans to the primary sector was held back though by a decline in new leases for forestry reprocessing machinery.4

The industrial sector, where economic activity was already in decline at the end of last year, took 43% less in long-term loans in the past seven months than in the same period last year. The reduction in aggregate new long-term borrowing in the early stages of the crisis was driven largely by the real estate and construction sector, but in recent months new borrowing by this sector has been close to or even above its average of earlier years. The logistics sector has cut both its long-term and short-term borrowing by almost half in the past seven months as a whole, partly because of the severe blow dealt by the crisis but also possibly because of the planned regulation by the European Union of the road transport sector.

- 25.01.2021 Как банкиры 90-х делили «золотую милю» в Юрмале

- 29.12.2020 В Rietumu и в этот раз создали особые праздничные открытки и календари 2021

- 29.12.2020 Lithuanian president signs 2021 budget bill into law

- 29.12.2020 Number of new companies registered in Estonia up in 2020

- 29.12.2020 Президент Литвы утвердил бюджет 2021 года

- 28.12.2020 Рынок недвижимости Эстонии осенью начал быстро восстанавливаться

- 28.12.2020 Tartu to support students' solar car project

- 28.12.2020 Owner of Kunda Nordic Tsement to install full-scale CCS facility in Norway

- 28.12.2020 New Year Cards and Calendars of Rietumu Bank presented

- 23.12.2020 В 2019 году выросли прибыль и оборот Eesti Pagar

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!